[#4] Checkout Flow - The Trust Multiplier (3a/3)

After breaking down how modern online payments work (Part 1) and where they fail (Part 2), we're completing this foundational series by diving into how the pros handle those failure points.

Here's the key insight that will serve as our guide for Part 3:

From a user's perspective, there aren't really six technical stages to worry about.

There are only two experiences that matter:

1. Checkout: Getting from shopping cart to clicking "Pay Now" (Stage 1)

2. Processing: Getting from "Pay Now" to "Order Confirmed" (Stage 2-6)

Accordingly, I'm breaking Part 3 into two focused pieces:

- 3a on Checkout Strategy (this issue)

- 3b on Processing Optimization (next week's issue)

Today we're starting with Checkout. That critical moment when customers decide whether to trust you with their money.

Last week, I tried to buy a dress shirt from a brand I'd discovered on Instagram. Slim fit, supposedly high quality, good reviews. I'd been looking for something like this.

I loaded it into my cart, got to checkout, and then... paused. "Why do they need my phone number? I can't use Apple Pay? Such a long checkout form. And what's this $15 shipping charge that wasn't mentioned before?"

I closed the tab and ordered from Brooks Brothers instead. Same style, 30% markup, but I trusted the checkout experience (and could just use Apple Pay!).

That brand just lost a customer, wasted their ad spend, and probably lost $2,000+ in lifetime value because they treated checkout like a form to fill out instead of a trust test to pass.

Why Checkout Matters

Worldwide, 70% of customers abandon their shopping carts during checkout (source), with abandonment rates hitting 85% on mobile. (source). Worse, customers who abandon at checkout rarely come back. They don't bookmark your site for later. They don't sign up for price alerts. They go to your competitors and buy there instead.

What most online businesses don’t realize is that the abandonment rates for top performing businesses are half those of the worst performing ones (source). In fact, research shows that the average e-commerce site can improve conversion by 35% through checkout design alone (source).

Just to put this in perspective, If we look at the combined ecommerce sales of $738 billion in the US and EU, the potential for a 35.26% increase in conversion rate translates to $260 billion worth of lost orders which are recoverable solely through a better checkout flow & design.

Clearly, a large majority of online businesses are literally leaving money on the table (and worse, losing future value and hurting their brand) by ignoring checkout optimization

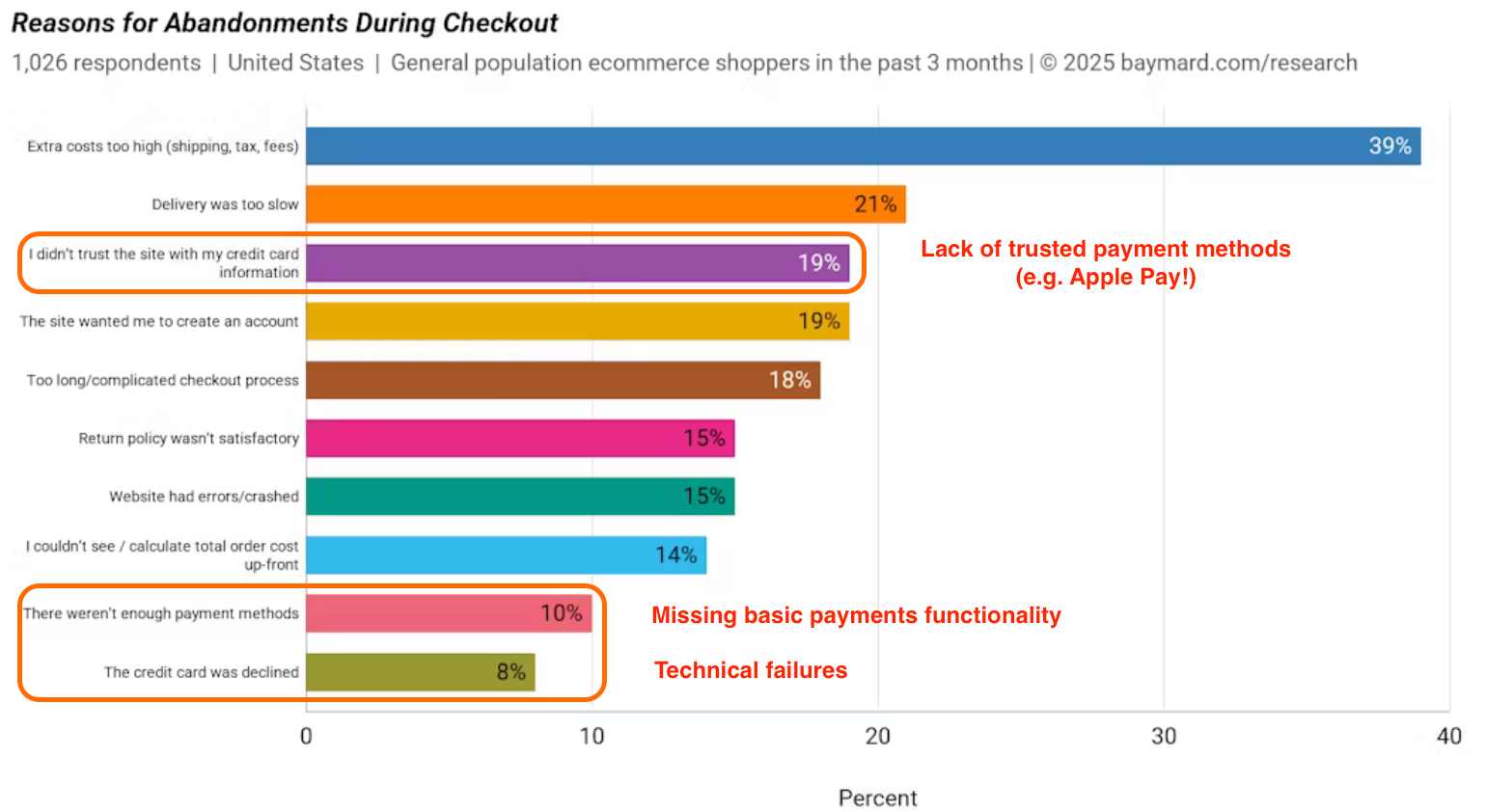

Most relevant for us at DMP though is the fact that after surprise costs (e.g. shipping costs), payments issues are the #1 reason for checkout abandonment.

Recall Stage 1 of the modern online payment flow is the merchant’s own risk checks. Unfortunately, your own fraud systems might be sabotaging you here. Research shows 15% of valid payments get flagged as fraud, causing 32% of customers to abandon the brand completely (source) and 22% of payments drop off during 3DS authentication due to poor UX and time-outs (source).

Philosophically, what most companies are missing is that checkout failures aren't technical problems, they're trust problems.

Every field you ask for, every surprise fee, every friction point is a test of whether customers believe you're worth the risk.

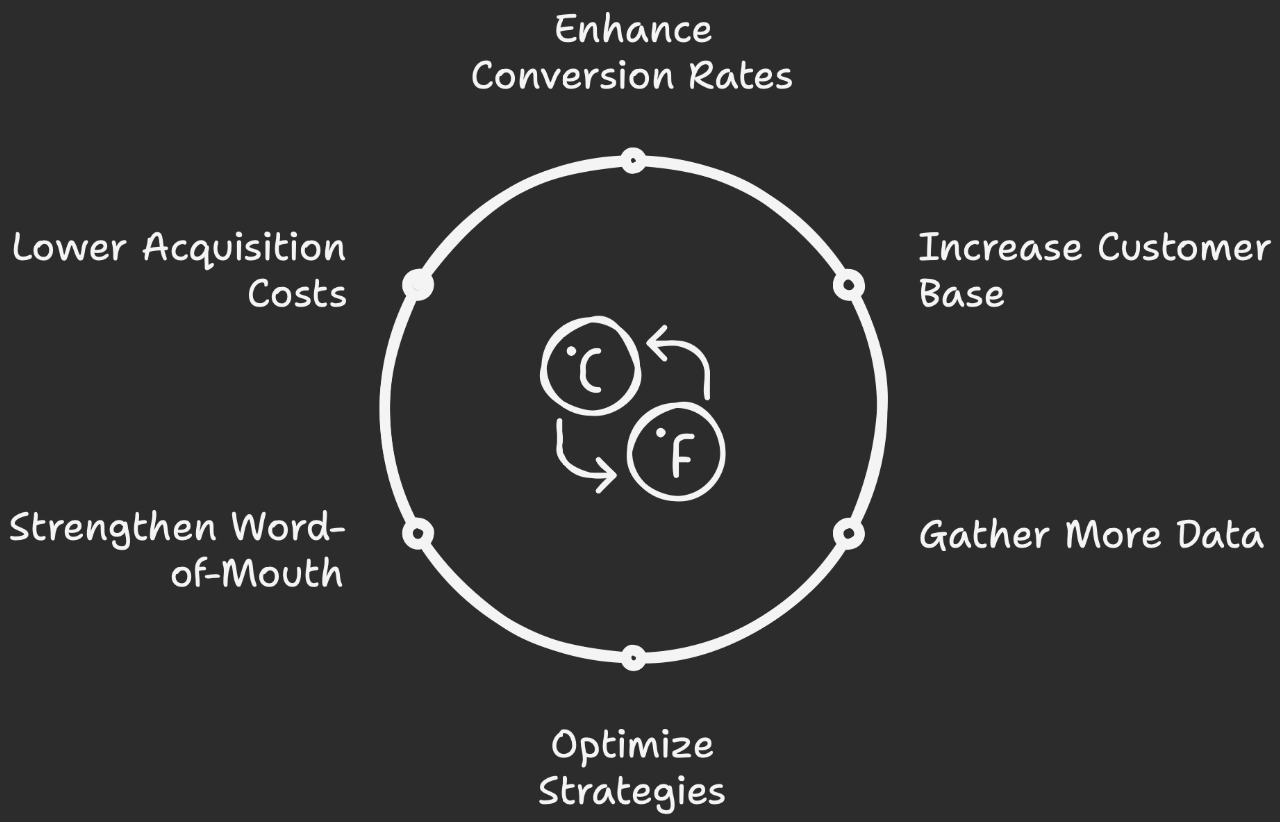

While you're losing customers to checkout friction, competitors with better experiences are capturing them AND learning from that data to improve further.

Strategy: Checkout as Your Secret Weapon

Most companies think checkout optimization is about conversion tweaks. A few percentage points here, some A/B tests there, maybe add Apple Pay, and call it a day.

Elite companies know better. They treat checkout as a trust engine.

Every element of your checkout page either builds confidence or erodes it. The number of fields. The payment options you offer. Whether surprise fees appear. How you handle errors. Whether customers recognize and trust your payment experience.

The Trust Multiplier in Action

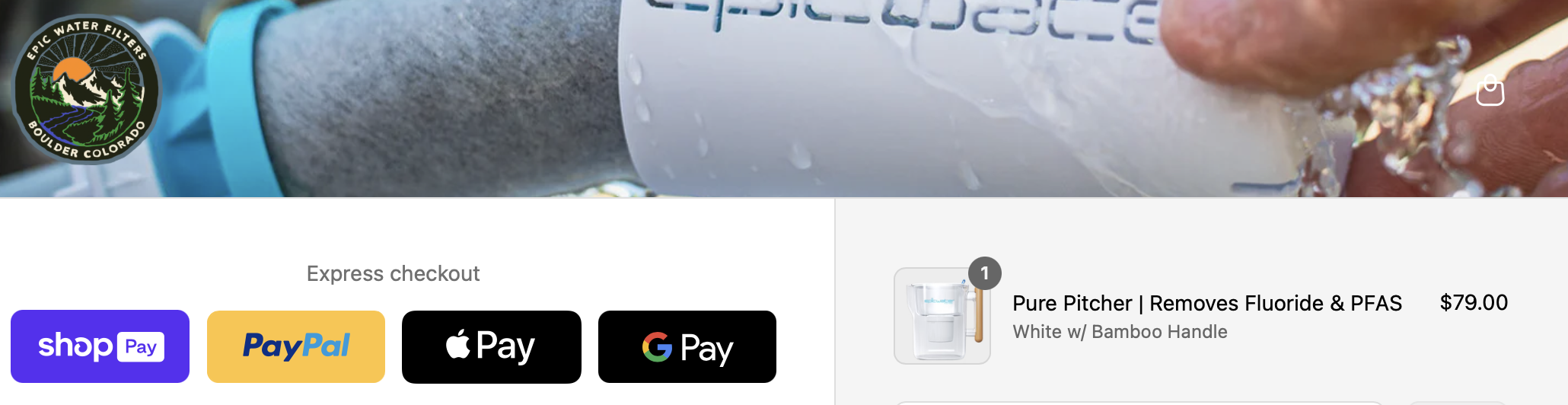

Let me tell you about Epic Water Filters, a company that figured this out (case study).

They started as a basement operation selling water filters direct-to-consumer. Good product, decent marketing, but competing against giants like Brita with way deeper pockets for ads and brand recognition.

Then they made a simple but brilliant strategic decision: they added Amazon Buy with Prime to their DTC website.

Result? 40% (!!!) conversion increase.

When Epic asked customers why, the feedback was clear: "greater credibility." Customers saw the familiar Amazon checkout and instantly felt more confident buying from a brand they’d never heard of.

They key to realize here is that Epic didn't just add a payment option, they borrowed Amazon's trust to compete with bigger players. They went from basement startup to 12-person operation, largely because they understood that checkout trust translates directly to brand trust.

Investing in your checkout experience isn’t about convenience. It's about confidence.

PS: Epic Water Filters have since shifted to Stripe for their Checkout UI (and likely their payment processing as well), and thus now offer the standard gamut of Apple Pay, Shop Pay, Google Pay. No more revenue leaks due to unoptimized checkout but there might still be optimizations to be made for Processing... (stay tuned for Part 2!)

The Core Strategic Choice: Partner or Build?

Epic's success highlights the fundamental decision every company accepting online payments faces:

Partner: Leverage existing trusted checkout experiences (Apple Pay, Buy with Prime, Shop Pay)

OR

Build: Invest in custom payment flows for control and differentiation

While this decision deserves its own dedicated article, here are some signals you can use to evaluate which makes more sense for you.

When to Partner:

- You’re early stage, and need speed to market

- Limited engineering resources

- Your product is relatively standard (think water bottles, hoodies, shower caps)

- You want to focus on growing the core business, not payments infrastructure

When to Build:

- You’re at scale ($10M+ ARR typically)

- You have unique payment requirements

- You have engineering capacity to dedicate specifically for payments

- Control and differentiation are priorities

Most companies should start with partnering and graduate to building as they scale. Epic Water Filters partnered while Ramp built their own payment integrations (see their excellent engineering blog to understand how much effort goes into it). A similar example of the latter is Sana partnering with Modern Treasury instead of spending $70k to build a custom payment integration and $150k annually to maintain it (case study).

Both work, but picking wrong for your stage can waste a bunch of time and money.

There's no profitable middle ground in checkout. Either build world-class or partner with world-class.

Mediocre custom checkout is where you lose the sale AND future value from that customer AND hurt your brand trust

Most companies fall into the "checkout uncanny valley" i.e. they build custom checkout because they think they should, but it's worse than just using Stripe’s Checkout UI or Apple Pay or Buy with Prime. They get neither the trust benefits of partnering nor the control benefits of going best-in-class.

Epic succeeded because they recognized they couldn't out-checkout Amazon, so they borrowed Amazon's trust instead. Companies with mediocre custom checkout would literally make more money by just adding "Pay with Apple Pay."

The strategic choice is binary: trust arbitrage or experience differentiation. Pick one and go all-in.

Tactics: The Checkout Optimization Framework

Strategy sets direction, but tactics win games. Think of systematically improve checkout in levels of increasing complexity & impact:

Remove Friction → Add Trust Signals → Optimize Intelligence

Level 1: Remove Friction

Start by stopping the bleeding. These are the quick wins that immediately reduce abandonment:

- Add guest checkout option: 24% of customers abandon when forced to create an account. Guest checkout isn't just nice-to-have. It's revenue protection.

- Minimize required fields: Each additional field increases abandonment by roughly 7%! (source) Ask yourself: do you really need their phone number before they buy? Their company name? Middle initial? Every field should justify its existence.

- Hide unexpected fees upfront: 55% of customers abandon due to surprise charges. If you're going to charge shipping, taxes, or fees, show them before checkout starts. Surprises at payment kill trust instantly.

PS: Some relevant resources from Shopify, and others.

Insider tip: the pros typically do some sort of Checkout UX audit somewhat regularly, either internally or from an agency like Mouseflow or Trafiki.

Level 2: Add Trust Signals

Once you've removed the obvious friction, start building confidence:

- Offer familiar payment methods: Apple Pay, Buy with Prime, Shop Pay aren't just about convenience - they're trust signals. When customers see these options, they know you're legitimate. Amazon's research touts 25% abandonment reduction (source), but the real value is credibility.

- Display security indicators: SSL badges, payment provider logos (Visa, Mastercard, Stripe), security certifications. These seem basic, but they work. Customers are giving you their financial information and you should make it obvious you take security seriously!

- Show total cost clearly: No math required. Show product price + shipping + taxes = total upfront. Customers should never have to calculate anything or encounter surprises.

Level 3: Optimize Intelligence

This is where the real competitive advantage lives:

- Use 3D Secure strategically: Most companies either never use 3DS or always use it. Smart companies use it as a fallback for risky transactions only. Always-on 3DS kills 15-25% of conversion (source) whereas never using it increases fraud. The intelligent approach: build intelligent risk models and trigger 3DS only when they flag potential fraud.

- Monitor false positive rates: Your fraud prevention might be blocking good customers. Track who you're declining and why. That international customer who got blocked? They might have been your next whale customer. Review your blocking patterns monthly.

- Build A/B testing framework: Test everything, but systematically. Checkout button color, field order, payment method positioning, trust badge placement. Small improvements compound into significant revenue gains over time.

Implementation Priority

Don't try to fix everything at once. Here's your roadmap:

Week 1: Add guest checkout, remove unnecessary fields, show total cost upfront

Month 1: Implement Apple Pay/Google Pay, add security badges

Quarter 1: Smart fraud rule optimization, systematic A/B testing setup

Each phase builds on the last. Get the basics right before optimizing the advanced stuff.

The Compound Effect

Every checkout improvement compounds, and the cumulative effect can be very significant for your top-line.

Epic's 40% boost wasn't just that quarter's revenue, it was about building a trust engine that keeps paying dividends.

Your checkout isn't just where customers pay. It's where they decide whether to trust you, recommend you, and return to you.

Getting customers through checkout is half the battle. Once they click "Pay Now," the real strategic opportunities begin.

Next week, we'll dive into the invisible optimization layer between that click and "Order Confirmed". This is where elite companies build their most sustainable competitive advantages.

Building something with payments? Ping me at abdur@paymentswithabdur.com! Always happy to chat about payment optimization :)

P.S. I eventually went back and bought that dress shirt. Took three weeks and a 20% off email to overcome initial checkout friction. That's three weeks of delayed revenue and higher acquisition costs, all because of a phone number field and surprise shipping charges.